After Two Years of the Pandemic, Americans Place High Value on Tailored Financial Strategies

Allianz Life study finds better preparation among those working with a financial professional, but opportunity remains for finpros to help with life-stage-specific planning and Social Security strategy

Key findings:

- 93% of Americans said setting financial goals and developing a plan to achieve them is important to helping support their future ambitions; 86% cite the benefits of working with a financial professional

- 44% of respondents said making sure they have enough money to last their lifetime is one of the most important things financial professionals can do to help

- 59% of near-retirees say they are planning to work past the current Social Security retirement age; only 11% of current retirees actually did so

As Americans continue to manage their finances during the uncertainty brought on by the pandemic, financial planning with the assistance of a professional is helping them feel more confident about the future.

More than nine in 10 respondents (93%) said setting financial goals and developing a plan to achieve them is important to helping them support their future ambitions, with another 86% citing the benefits of working with a financial professional, according to the new 2022 Retirement Risk Readiness Study* from Allianz Life Insurance Company of North America (Allianz Life).

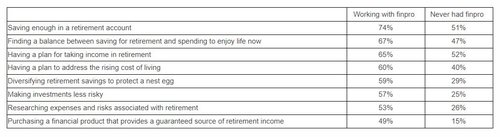

Accordingly, those who are already working with a financial professional are feeling significantly more prepared to manage a number of potential risks to their retirement, including saving enough, having a plan for retirement income, and addressing the rising cost of living:

So many Americans are in a vulnerable spot right now with their finances, it’s encouraging to see the high value placed on not only the practice of financial planning, but also the guidance of a financial professional,” said Kelly LaVigne, vice president of Consumer Insights, Allianz Life. “The pandemic changed a lot of expectations around finances and creating a retirement strategy, so now is the right time for financial professionals to understand, adapt, and meet clients where they are.”

Opportunity to help with life-stage-specific planning

The 2022 Retirement Risk Readiness Study surveyed three categories of Americans to get different perspectives on retirement: pre-retirees (those 10 years or more from retirement); near-retirees (those within 10 years of retirement); and those who are already retired.

Regardless of life stage, people want to make sure they have enough money to last their lifetime. Over four in 10 (44%) respondents said making sure they have enough money is one of the most important things financial professionals can do to help. Still, the 2022 study identified several areas where these different groups of Americans are looking for specific assistance based on their proximity to retirement.

Retirees are focused on having their financial professional:

- Maximize investment return: 56% vs. 38% near-retirees and 43% pre-retirees

- Protect investments from market loss: 45% vs. 39% near-retirees and 32% pre-retirees

- Minimize tax burden: 43% vs. 36% near-retirees and 31% pre-retirees

- Near-retirees are most interested in getting help with:

- Maximizing their Social Security benefit in retirement: 34% vs. 27% pre-retirees and 25% retirees

- Making the best decisions about Medicare and health insurance: 30% vs. 23% pre-retirees and 22% retirees

Pre-retirees are more likely than others to want their financial professional’s assistance in:

- Securing their children’s financial future: 35% vs. 23% near-retirees and 13% retirees

- Balancing their budget to save for later while enjoying life now: 33% vs. 25% near-retirees and 26% retirees

- Paying down debt: 27% vs. 19% near-retirees and 16% retirees

Pre-retirees also expect a different level of engagement with their financial professional, in terms of both service and strategy. A higher percentage of pre-retirees expect their finpro to be tech savvy, offering interactive tools to understand finances under a variety of scenarios (58% vs 48% near-retirees and 37% retirees) and being flexible with meeting options, including virtual meetings, to meet their needs (50% vs 43% near-retirees and 48% retirees). In addition, more pre-retirees are interested in exploring a non-traditional life path where they may try different things at different times instead of following the traditional school-work-retirement path (54% vs. 48% near-retirees and 36% retirees).

Social Security misconceptions remain

One area where many Americans continue to struggle is with their Social Security strategy. Although most think they have a good plan for when they’ll start taking Social Security benefits and a clear understanding of the role it will play in their overall retirement finances, study findings show that expectations are different from reality.

About six in ten (59%) near-retirees say they are planning to work past the current Social Security retirement age. However, only one in ten (11%) current retirees actually did so. Moreover, over half of near-retirees (57%) expect to take benefits at full retirement age or defer to a later age, whereas only four in ten (46%) retirees did so. Additionally, only one-third (33%) of near-retirees plan to take Social Security benefits before full retirement age, while in reality, nearly half (49%) of current retirees had to take their benefits early, limiting their maximum benefit.

These misconceptions extend to expectations about the role Social Security will play in their overall retirement income strategy. More near retirees (40%) and pre-retirees (35%) believe that people will get enough from Social Security to meet their needs in retirement; only 10% of retirees said this is true.

“Miscalculating how much you can depend on Social Security benefits can have a detrimental effect on your financial health throughout retirement,” added LaVigne. “Financial professionals have the tools to help people make informed decisions about a number of complex topics, including a Social Security strategy, so their clients have a better chance of avoiding any pitfalls that can result from a lack of planning.” Keep in mind financial professionals can offer information regarding Social Security benefits, but generally cannot offer individualized advice.

*Allianz Life conducted an online survey, the 2022 Retirement Risk Readiness Study, in February 2022 with a nationally representative sample of 1,000 individuals age 25+ in the contiguous U.S. with an annual household income of $50k+ (single) / $75k+ (married/partnered) OR investable assets of $150k.

This content is for general educational purposes only. It is not, however, intended to provide fiduciary, tax or legal advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that Allianz Life Insurance Company of North America, its affiliated companies, and their representatives and employees do not give fiduciary, tax or legal advice or advice related to Social Security or Medicare. Clients are encouraged to consult their tax advisor, attorney or Social Security Administration (SSA) office for their particular situation.

About Allianz Life Insurance Company of North America

Allianz Life Insurance Company of North America, one of the FORTUNE 100 Best Companies to Work For® and one of the Ethisphere World’s Most Ethical Companies®, has been keeping its promises since 1896 by helping Americans achieve their retirement income and protection goals with a variety of annuity and life insurance products. In 2021, Allianz Life provided additional value to its policyholders via distributions of more than $10.6 billion. As a leading provider of fixed index annuities, registered index-linked annuities and fixed index universal life insurance, Allianz Life is part of Allianz SE, a global leader in the financial services industry with approximately 150,000 employees in more than 70 countries. Allianz Life is a proud sponsor of Allianz Field® in St. Paul, Minnesota, home of Major League Soccer’s Minnesota United.

Annuity Alliance is sharing this information as educational use only and should not be used to make a financial decision. Annuity Alliance is not associated with Allianz Life Insurance Company of North America.