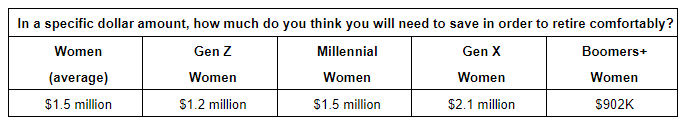

Gen X Women On Average Believe They Will Need Over $2 Million to Retire Comfortably

Worried About Wealth: Gen X women report higher levels of financial anxiety about retirement preparedness

"Generation Zeal:" Gen Z women plan to retire nine years before Boomer women and pay off their student loans a decade sooner than Millennial women

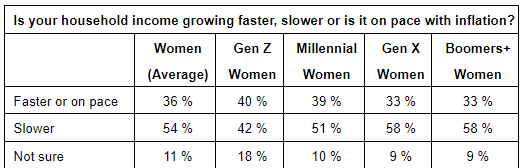

Growing Up Fast: Income growth is strongest among Gen Z and Millennial women, with about 4 in 10 saying it's climbing faster than or on pace with inflation

With retirement dreams on the horizon, Gen X women on average believe they will need more than $2 million to retire comfortably, more than any other generation of women. Meanwhile, the average retirement savings goal among Boomer+ women is seven-figures smaller: $902,000. But arguably, the largest generational difference between women is one rooted in attitudes and beliefs: six in 10 (60%) Gen Z women think they will be financially prepared to retire when the time comes, while just 40% of Gen X women agree. These are the latest findings of Northwestern Mutual's 2024 Planning & Progress Study, the company's proprietary research series exploring Americans' attitudes, behaviors and perspectives across a broad set of issues impacting their long-term financial security.

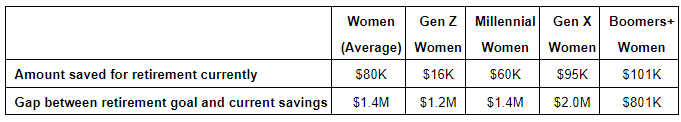

Gen X women report being furthest away from their retirement goals, having $95,000 on average saved for retirement.

Perhaps unsurprisingly, many Gen X women described themselves as financially insecure, with 42% saying they do not feel secure. Moreover, 10% of Gen X women say they are currently unemployed and unable to work due to an injury or an illness.

"When it comes to retirement, every person is unique, with goals, worries and opportunities important to them. That's why everyone deserves a comprehensive and custom financial plan to help protect the wealth they have built, create future prosperity and achieve retirements as distinctive as they are," said Kamilah Williams-Kemp, chief product officer at Northwestern Mutual. "That said, it can be especially stressful to see retirement out on the horizon and not feel prepared. Now is the time for Gen X women to convert their anxiety into confidence with a plan – specifically, a comprehensive financial plan created with an advisor who gets you. Their experience should also be a wakeup call for younger women that building a great plan now can help make the most of the time to save, and reduce the worry down the road."

Retirement uncertainty and insecurity

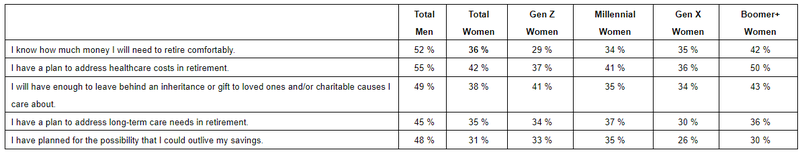

Only one-third (36%) of women indicate they know how much money they will need to retire comfortably. And nearly one quarter (24%) say they have less than 1x their current annual income saved for retirement.

"When I see statistics like this, the first thing I wonder is if women are feeling overly anxious or if men are feeling more confident than they should be," said Williams-Kemp. "The real answer is likely somewhere in the middle – and as a result, both should seek ways to feel more secure and stress test the financial plans and assumptions they've made."

Generation Zeal steps forward with confidence

Generation Z women say they aim to retire nine years sooner than Boomer+ women (by age 62 vs. 71). They also expect to pay off their college loans a full decade earlier than their Millennial counterparts (by age 33 vs. 43). These feelings of confidence also extend to their retirement planning: six in 10 (60%) Gen Z women think they will be financially prepared to retire when the time comes, while just 40% of Gen X women agree.

Younger women are also more likely than women in other generations to report that their household income is growing faster than or keeping pace with inflation.

They're also some of the most confident consumers: 57% of Gen Z women say they will spend more or the same in 2024 while just 37% expect to spend less.

"The youngest generation of women is setting ambitious financial goals, and with their rising incomes, side hustles and early investing, they may have the financial fuel they need to reach them," said Williams-Kemp. "The key question is this: alongside investing, will these young women protect what they've already built from risks, too? An investing-only approach leaves people alike vulnerable to unforeseen events in life – like a disability, illness or unexpected loss of a spouse. That's why I encourage everyone to build a financial plan with a strong foundation in risk management to ensure that it's built to last."

Advice for the ages

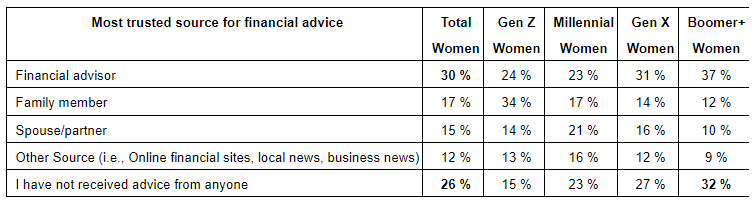

The study finds that younger women are more inclined than older women to put their trust in family members and spouses when it comes to getting financial advice. Among older adult women, their most trusted source of financial advice is definitively with advisors. That said, one quarter (26%) of women have not received advice from anyone, and for Boomer+ women the number is even higher – 32%.

"My message to women is they are not alone in figuring out their long-term financial plans," said Williams-Kemp. "Regardless of your age, circumstances or expertise, find a professional financial advisor who you trust and put a solid plan in place. Those two steps can make a world of difference toward achieving greater certainty in the near term and financial security down the road."

About The 2024 Northwestern Mutual Planning & Progress Study

The 2024 Planning & Progress Study was conducted by The Harris Poll on behalf of Northwestern Mutual among 4,588 U.S. adults aged 18 or older. The survey was conducted online between January 3 and January 17, 2024. Data are weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population. A complete survey methodology is available.

About Northwestern Mutual

Northwestern Mutual has been helping people and businesses achieve financial security for more than 165 years. Through a comprehensive planning approach, Northwestern Mutual combines the expertise of its financial professionals with a personalized digital experience and industry-leading products to help its clients plan for what's most important. With over $627 billion of total assetsi being managed across the company's institutional portfolio as well as retail investment client portfolios, more than $36 billion in revenues, and $2.3 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than five million people with life, disability income and long-term care insurance, annuities, and brokerage and advisory services. Northwestern Mutual ranked 110 on the 2024 FORTUNE 500 and was recognized by FORTUNE® as one of the "World's Most Admired" life insurance companies in 2024.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI (life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries. Subsidiaries include Northwestern Mutual Investment Services, LLC (NMIS) (investment brokerage services), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company® (NMWMC) (investment advisory and services), federal savings bank; and Northwestern Long Term Care Insurance Company (NLTC) (long-term care insurance). Not all Northwestern Mutual representatives are advisors. Only those representatives with "Advisor" in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services.

1 Includes investments and separate account assets of Northwestern Mutual as well as retail investment client assets held or managed by Northwestern Mutual.

Annuity Alliance is not affiliated with Northwestern Mutual. This article is for informational and educational purposes only. It should not be used to make a buying decision. If you would like to speak with a financial professional at Annuity Alliance using the Contact Form.