Understanding Risk and Confidence in Your Retirement Planning

During the last two years, the nation’s economy has fluctuated with the up and downs created in the marketplace by the COVID-19 pandemic. The uncertainty has caused consumers to re-evaluate their retirement strategy to protect the hard-earned dollars they have saved for a hopefully relaxed and enjoyable retirement.

This week, Annuity Alliance discusses some of the risks involved with retirement planning as well as the confidence level of consumers as we finish off 2021.

Retirement Risks

- Longevity remains a considerable risk in retirement. SRI projects 25% of 65-year-old men of average health will live to age 89 and 25% of 65-year-old-women will live to age 92 — more than a decade longer than the overall U.S. population life expectancy of 77.3 in 2021.

- According to SRI research, 57% of all American workers expressed concern about outliving their assets in retirement. This concern is growing among retirees as well. A third of retirees (32%) indicated that they had major concerns about longevity risk in 2020; 12 percentage points higher than in 2006.

- Consumers (retired or not) say they are most concerned about reduced Social Security and Medicare benefits. Four in 10 also have heightened concern about costs associated with long term care and health care expenses not covered by Medicare.

- Other factors that retirees think could undermine their retirement security include increased taxes (36%), inflation (35%), and market volatility (24%).

Confidence in Retirement Security

- Overall, 6 in 10 Americans (57%) feel at least somewhat confident that they will be able to live their desired lifestyle in retirement. This confidence is lower for women (48%) and those with under $100,000 in household assets.

- Working with a financial professional is associated with increased confidence. While 72% of people who work with a financial professional feel confident that they will be able to live their desired lifestyle, just 48% of people who go it alone feel the same.

- Those with a formal written retirement plan are twice as likely as those with no retirement plan to be confident that they can live their desired lifestyle (79% versus 38%).

- Americans who work with an advisor are nearly twice as likely as those who don’t work with an advisor to feel “very prepared” for retirement (44% versus 23%).

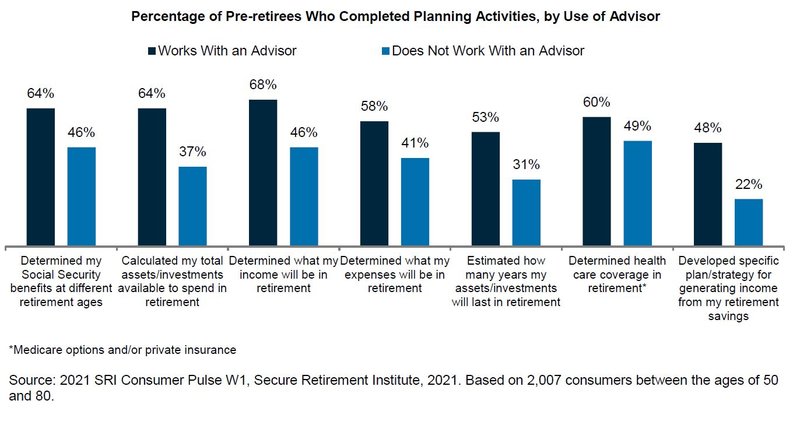

- Overall, those who work with an advisor are more likely to have completed basic retirement planning activities, such as calculating retirement assets and investment, calculating retirement expenses and income, and developing an income strategy to generate retirement income.

- Among pre-retirees who work with advisors, those with a formal written retirement plan are more likely than those without a plan to feel “very prepared” for retirement, 68% versus 41%, respectively.

Are you looking to review your retirement planning strategy with a financial professional? Would purchasing an annuity make sense based on your current stage in life? Contact Annuity Alliance to get connected today!

This article is distributed by the Secure Retirement Institute.