Understanding the FA Protection Benefits of a GLWB Rider

For generations, employer-sponsored pension plans provided workers with a paycheck for life — one not subject to market or longevity risks. However, throughout the past 50 years, the availability of these plans has declined by as much as 65 percent. This lack of predictable, lasting income combined with low interest rates has challenged traditional retirement funding strategies, a challenge made more acute by increased longevity.

Accordingly, pre-retirees have had to identify other solutions to help them accumulate enough wealth to last throughout retirement. Fixed and fixed indexed annuities have always provided a compelling value to consumers interested in protecting their retirement savings from market declines. In addition to offering principal protection, traditional fixed rate annuities provide competitive interest rates for continued asset accumulation that may compare favorably to CDs, government bonds, and other fixed-income investments. Fixed indexed annuities also guarantee safety of principal but offer more upside potential.

As 10,000 people turn 65 each day and access to employer-sponsored pension plans continues to decline, creation of guaranteed lifetime income is critical. In response, the fixed annuity industry has innovated the guaranteed lifetime withdrawal benefit (GLWB). When added to a fixed or fixed indexed annuity, this benefit is designed to provide contractually guaranteed lifetime income (cash flow) as part of the annuity owner’s retirement income plan at a potentially higher payout rate than traditional annuitization may provide.

How a Withdrawal Benefit Rider Works

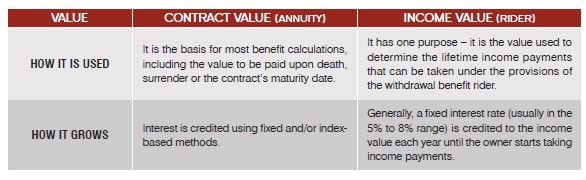

A guaranteed lifetime income or withdrawal benefit is typically optional on a fixed or fixed indexed annuity, and added to the annuity contract in the form of a rider. Whereas the underlying annuity has a contract value, the rider has a separate value commonly referred to as the income benefit base or income value.

The contract value of a fixed or fixed indexed annuity grows through the crediting of interest, either through a declared interest rate, or interest linked to the positive performance of a market index. With a fixed indexed annuity, the owner has a choice of fixed and index-based interest crediting strategies with which to earn interest. For each index-based strategy, the annuity credits interest to the contract value during periods in which the index increases.

The more the index increases, generally the higher the interest credit, subject to certain caps, participation rates or other limitations. However, in a period that the index declines, the annuity’s contract value is completely protected and suffers no loss whatsoever.

The rider’s income value is separate from the annuity’s contract value. The income value typically grows at a fixed rate (say 5% to 8%) or through participation in an index, or a combination of both. Then, once the owner elects to start taking lifetime income withdrawals, an age-based payout factor is applied to the income value to determine the guaranteed annual withdrawal amount. The older the owner/annuitant is when starting lifetime income, the higher the payout factor. Ultimately, the annuity owner(s) can enjoy more peace of mind knowing that he, she or they may withdraw that amount from the annuity every year for life.

While taking these withdrawals, the owner is provided with two valuable guarantees. First, although the annual withdrawals under the rider are deducted from the annuity’s contract value, interest continues to be credited to the remaining contract value using the same methods as discussed above, and the purchaser retains access to the remaining contract value at all times (usually subject to a declining surrender charge schedule and market value adjustment). Second, even if the annual withdrawals ultimately reduce the contract value to zero, the issuing insurance carrier is contractually obligated to continue making the annual income payments as long as the owner (or annuitant) lives.

There is no other product that provides this powerful combination of growth potential, principal protection, lifetime income and access to remaining contract value, hence creating the fixed annuity advantage.

The guaranteed lifetime income or withdrawal benefit rider can add a valuable insurance benefit to the contract for anyone who is interested in a potentially higher guaranteed lifetime income stream than contract annuitization may provide. Thus, most income riders are available for an additional cost. Some annuity contracts include the rider cost in the annuity product, so the cost is reflected in a lower interest crediting rate on the contract value. Other annuity contracts deduct a fee from the contract value of the annuity, usually as a percentage of the income value. On a fixed indexed annuity, this charge may cause the contract value to fall in years in which no interest is credited. Rider charges normally continue until the contract value of the annuity is depleted or the rider is removed from the contract.

The combination of changes to defined benefit pension plans, low interest rates and increased longevity have created substantial challenges for consumers trying to create reliable retirement income. Thankfully, fixed and fixed indexed annuities with a guaranteed lifetime withdrawal benefit rider can be a great fit for people looking for guaranteed lifetime retirement income without giving up access to their money.

Annuity guarantees are backed by the claims-paying ability of the issuing insurance company.